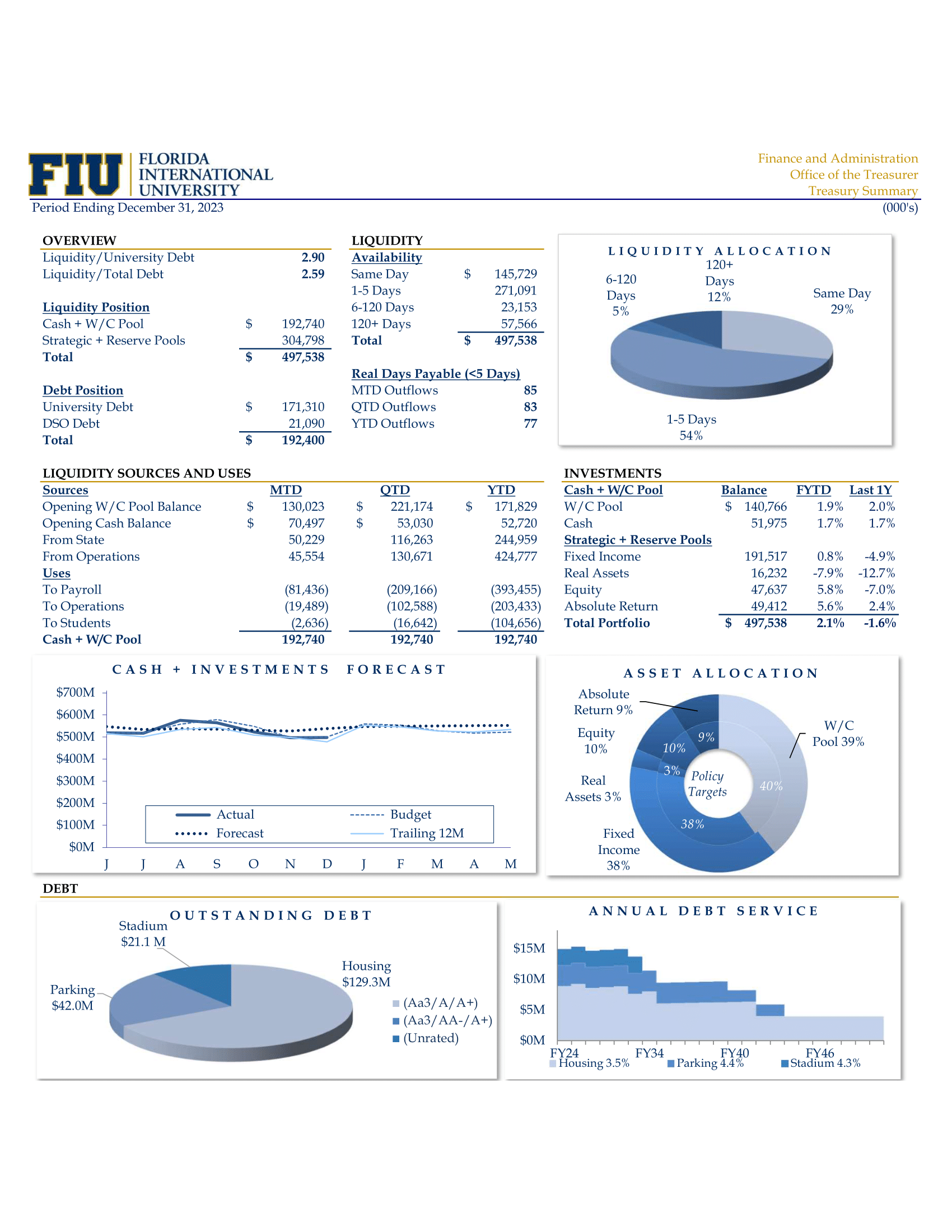

The Treasurer's Office oversees the investment of the University's cash and operating funds. The Treasurer is charged with investing and overseeing the University's short and long-term funds with a market value as of fiscal year ending June 30, 2023

of approximately $519.0 million, by maximizing total return consistent with reasonable protection of principal and in accordance with the Board of Trustees investments policies and philosophy. The portfolio is comprised of a series of externally

managed equity, fixed income and alternative investments. The office's investment responsibilities include the management of the asset allocation of the University's investment portfolio; oversight of external investment managers; reconciliation

services for all bank accounts and timely reporting and performance analysis for all portfolios, and providing the CFO, President, and Board of Trustee committees with the information they require to responsibly oversee investment activities.

Gerald Grant Jr, Chair

Gerald Grant Jr, two time "Branch Manager of the Year" for Great Western Bank, former Branch VP & Cluster Manager at Citibank, and Master of Business Administration from Florida International University, is Branch Director of Financial Planning for AXA Advisors' South Florida Branch. He also holds FINRA Series 7, 63, 65, 24, and 26 Securities Registrations and is insurance licensed. Grant now publishes financial advice through his book, 'Bold Moves to Creating Financial Wealth'. He actively participates in the South Florida community, serving on the Board of Directors for United Way of Miami-Dade. Gerald is a past-President of (NAIFA) National Association of Insurance and Financial Advisors, Miami-Dade Chapter, a past-President of the Florida International University Alumni Association, as well as a current Member of the Orange Bowl Committee, and Phi Beta Sigma Fraternity, Inc.-Theta Rho Sigma Chapter.

Gerald Grant Jr, two time "Branch Manager of the Year" for Great Western Bank, former Branch VP & Cluster Manager at Citibank, and Master of Business Administration from Florida International University, is Branch Director of Financial Planning for AXA Advisors' South Florida Branch. He also holds FINRA Series 7, 63, 65, 24, and 26 Securities Registrations and is insurance licensed. Grant now publishes financial advice through his book, 'Bold Moves to Creating Financial Wealth'. He actively participates in the South Florida community, serving on the Board of Directors for United Way of Miami-Dade. Gerald is a past-President of (NAIFA) National Association of Insurance and Financial Advisors, Miami-Dade Chapter, a past-President of the Florida International University Alumni Association, as well as a current Member of the Orange Bowl Committee, and Phi Beta Sigma Fraternity, Inc.-Theta Rho Sigma Chapter.

Joel R Barber, Ph.D.

Dr. Barber is currently a professor for the

Department of Finance. He has obtained a Ph.D. in Business Administration from the University of Arizona.

His areas of expertise are Asset Allocation, Security Analysis, Bonds and the impact of changes in Interest Rates. Dr. Barber's research has been published in

Financial Review,

Journal of Fixed Income,

Journal of Financial Research and Insurance: Mathematics and Economics ,

Journal of Portfolio Management,

Journal of Economics and Finance,

European Actuarial Journalism,

and others.

Dr. Barber is currently a professor for the

Department of Finance. He has obtained a Ph.D. in Business Administration from the University of Arizona.

His areas of expertise are Asset Allocation, Security Analysis, Bonds and the impact of changes in Interest Rates. Dr. Barber's research has been published in

Financial Review,

Journal of Fixed Income,

Journal of Financial Research and Insurance: Mathematics and Economics ,

Journal of Portfolio Management,

Journal of Economics and Finance,

European Actuarial Journalism,

and others.

Dean Colson

Dean Colson was born and raised in Miami, Florida. He earned his undergraduate degree from Princeton University, and graduated magna cum laude from the University of Miami School of Law. Upon graduation, he served as a law clerk for the Honorable Peter T. Fay, United States Court of Appeals, Fifth Circuit. In 1980, Mr. Colson was a law clerk for then Justice William H. Rehnquist, Supreme Court of the United States. Mr. Colson is a partner with the law firm of Colson Hicks Eidson. He has specialized in product liability, aviation and complex commercial litigation.

Mr. Colson is a past President of the Dade County Bar Association, and a past member of The Florida Bar. Mr. Colson is a Fellow of the American College of Trial Lawyers, a Fellow of the International Society of Barristers, and listed in The Best Lawyers in America. In 2009, Mr. Colson was appointed to the Federal Committee on Rules of Practice and Procedure by the Chief Justice of the United States and served through the completion of his term in 2015.

Mr. Colson has served on the Board of Directors of numerous charitable organizations in South Florida. He currently serves on the Board of the Institute of Contemporary Art, Miami. Mr. Colson served on the Board of Governors of the State University System of Florida, and served as Chair and Vice-Chair of the Board from (2010-2014). In 2017, the Board of Governors appointed Mr. Colson to serve on Florida International University’s Board of Trustees, and he became Chair of the Board in 2020.

Prior to his service in the public university system, Mr. Colson served as Chair of the Board of Trustees (2004-2007), and Chair of the Executive Committee of the University of Miami (1999-2004). He also served as Chair of the Academic Affairs Committee, and as Chair of the Law School’s Visiting Committee. Mr. Colson chaired the University’s billion-dollar capital campaign which raised $1.4 billion dollars.

In 2000, Governor Jeb Bush appointed Mr. Colson to the State of Florida Commission on Ethics. In 2002, Governor Bush appointed him to the Supreme Court Judicial Nominating Commission. Mr. Colson chaired the Commission from 2004 to 2008. Mr. Colson was Chair of Appointments for Governor Elect Charlie Crist’s Transition Committee. In 2009, Governor Crist named Mr. Colson his Special Advisor on Higher Education.

Mr. Colson is a past president of the Orange Bowl Committee and served as Chair of the South Florida Super Bowl XXIX Host Committee. Mr. Colson also chaired the committee that successfully bid on the 1999 and 2007 South Florida Super Bowls. Mr. Colson has received the Mayor of Miami’s “Citizen of the Year” award for his commitment to the betterment of his community, and in 1996 was named Sportsman of the Year by the Boys & Girls Club of Greater Miami. In 2008, Mr. Colson received the James W. McLamore Outstanding Volunteer Award given by the Miami-Dade Chapter of the Association of Fundraising Professionals. In 2009, Mr. Colson was honored with an Honorary Degree, Doctor of Laws from Florida International University. In 2010, Mr. Colson received the Jurisprudence award from the Anti-Defamation League.

Aime Martinez

Ms. Martinez is the Interim Chief Financial Officer and Vice President for Finance and Administration. She is responsible for the management and administration of financial, facility, and business service operations of the University. Ms. Martinez has more than 20 years of experience in the areas of accounting, finance, real estate, investments, strategic and business planning. Prior to her appointment in this position, Ms. Martinez oversaw the alignment of divisional goals with overall FIU strategies. Ms. Martinez served as senior officer for the Finance and Administration Division and was involved in a wide variety of complex and sensitive administrative support activities. She served as the acting Vice President in the absence of the CFO and Sr. Vice President for Finance and Administration. Aime Martinez previously served as the Assistant Vice President of the FIU Foundation, Inc., and Support Organizations for five years. In this role she managed and directed the entities’ accounting, investments, budgeting, information systems, internal and external audit, and associated personnel. She also represented the Foundation and DSOs in various board, community, and business meetings. Ms. Martinez was also the Foundation’s Assistant Treasurer. Ms. Martinez has participated in various University wide committees such as the University’s Worlds Ahead Strategic Planning Committee, where she served as Chair for the Finance Committee for two plans, served on the Finance Committee of the College of Medicine Strategic Plan and is currently serving as the Chair of the Student Health Services Joint Governance Committee, Treasurer of the FIU Research Foundation and Finance Section Chief of the Emergency Operations Command Team. After several years in the private sector as an auditor and tax preparer in a public accounting firm as well as an accounting manager for an oil and gas public company, handling their financial reporting, Ms. Martinez returned to FIU in 2000. She accepted a position as Assistant Controller and worked her way to become Assistant Vice President and Associate Controller. She served in that capacity for seven years, she managed several areas in the Controllers during her tenure, including financial reporting, purchasing card program, investment and construction accounting, cash management, accounts payable, general accounting, audit, and payroll. For her outstanding service to the University Aime Martinez was awarded the FIU Presidential Excellence Award in 2006 and the FIU Presidential Service Excellence award in 2016. Ms. Martinez received a bachelor’s in accounting in 1996 with a minor in International Business and a master’s in accounting in 1999; she is also a licensed Certified Public Accountant.

Ms. Martinez is the Interim Chief Financial Officer and Vice President for Finance and Administration. She is responsible for the management and administration of financial, facility, and business service operations of the University. Ms. Martinez has more than 20 years of experience in the areas of accounting, finance, real estate, investments, strategic and business planning. Prior to her appointment in this position, Ms. Martinez oversaw the alignment of divisional goals with overall FIU strategies. Ms. Martinez served as senior officer for the Finance and Administration Division and was involved in a wide variety of complex and sensitive administrative support activities. She served as the acting Vice President in the absence of the CFO and Sr. Vice President for Finance and Administration. Aime Martinez previously served as the Assistant Vice President of the FIU Foundation, Inc., and Support Organizations for five years. In this role she managed and directed the entities’ accounting, investments, budgeting, information systems, internal and external audit, and associated personnel. She also represented the Foundation and DSOs in various board, community, and business meetings. Ms. Martinez was also the Foundation’s Assistant Treasurer. Ms. Martinez has participated in various University wide committees such as the University’s Worlds Ahead Strategic Planning Committee, where she served as Chair for the Finance Committee for two plans, served on the Finance Committee of the College of Medicine Strategic Plan and is currently serving as the Chair of the Student Health Services Joint Governance Committee, Treasurer of the FIU Research Foundation and Finance Section Chief of the Emergency Operations Command Team. After several years in the private sector as an auditor and tax preparer in a public accounting firm as well as an accounting manager for an oil and gas public company, handling their financial reporting, Ms. Martinez returned to FIU in 2000. She accepted a position as Assistant Controller and worked her way to become Assistant Vice President and Associate Controller. She served in that capacity for seven years, she managed several areas in the Controllers during her tenure, including financial reporting, purchasing card program, investment and construction accounting, cash management, accounts payable, general accounting, audit, and payroll. For her outstanding service to the University Aime Martinez was awarded the FIU Presidential Excellence Award in 2006 and the FIU Presidential Service Excellence award in 2016. Ms. Martinez received a bachelor’s in accounting in 1996 with a minor in International Business and a master’s in accounting in 1999; she is also a licensed Certified Public Accountant.

Deanne Butchey, Ph.D., Vice-Chair

Dr Deanne Butchey is a Senior Lecturer in the Department of Finance at Florida International University (FIU) and holds a PhD in Finance. Before joining FIU, Dr. Butchey

worked as an Investment Banker and Financial Services Stock Research Analyst at Credit Suisse First Boston in their Toronto offices. Dr. Butchey has contributed significantly to FIU's initiatives to engage the community in mutually beneficial

ways. Since spring 2008, she has led a service learning project in her online Financial Markets and Institutions class where student groups teach financial literacy skills to high school students, recent immigrants and newcomers to South Florida

and other disenfranchised residents through various community centers (including the Chapman Community Partnership for Homeless), high schools, libraries and religious organizations. For this project she has been honored with the 2013 "Spirit

of Service-Learning Award" awarded by the Returned Peace Corps Volunteers of South Florida Inc. (RPCVSF), the Miami-Dade Teacher of the Year Coalition, and the Armando Alejandre Jr. Foundation. She is also a faculty advisor to ENACTUS @ FIU, a

student organization that aims to facilitate the impactful collaborations of students and community partners by creating, commercializing, and enhancing innovative social entrepreneurship projects to stimulate economic advancement.

Dr Deanne Butchey is a Senior Lecturer in the Department of Finance at Florida International University (FIU) and holds a PhD in Finance. Before joining FIU, Dr. Butchey

worked as an Investment Banker and Financial Services Stock Research Analyst at Credit Suisse First Boston in their Toronto offices. Dr. Butchey has contributed significantly to FIU's initiatives to engage the community in mutually beneficial

ways. Since spring 2008, she has led a service learning project in her online Financial Markets and Institutions class where student groups teach financial literacy skills to high school students, recent immigrants and newcomers to South Florida

and other disenfranchised residents through various community centers (including the Chapman Community Partnership for Homeless), high schools, libraries and religious organizations. For this project she has been honored with the 2013 "Spirit

of Service-Learning Award" awarded by the Returned Peace Corps Volunteers of South Florida Inc. (RPCVSF), the Miami-Dade Teacher of the Year Coalition, and the Armando Alejandre Jr. Foundation. She is also a faculty advisor to ENACTUS @ FIU, a

student organization that aims to facilitate the impactful collaborations of students and community partners by creating, commercializing, and enhancing innovative social entrepreneurship projects to stimulate economic advancement.

Benjamin Powell Jarrell

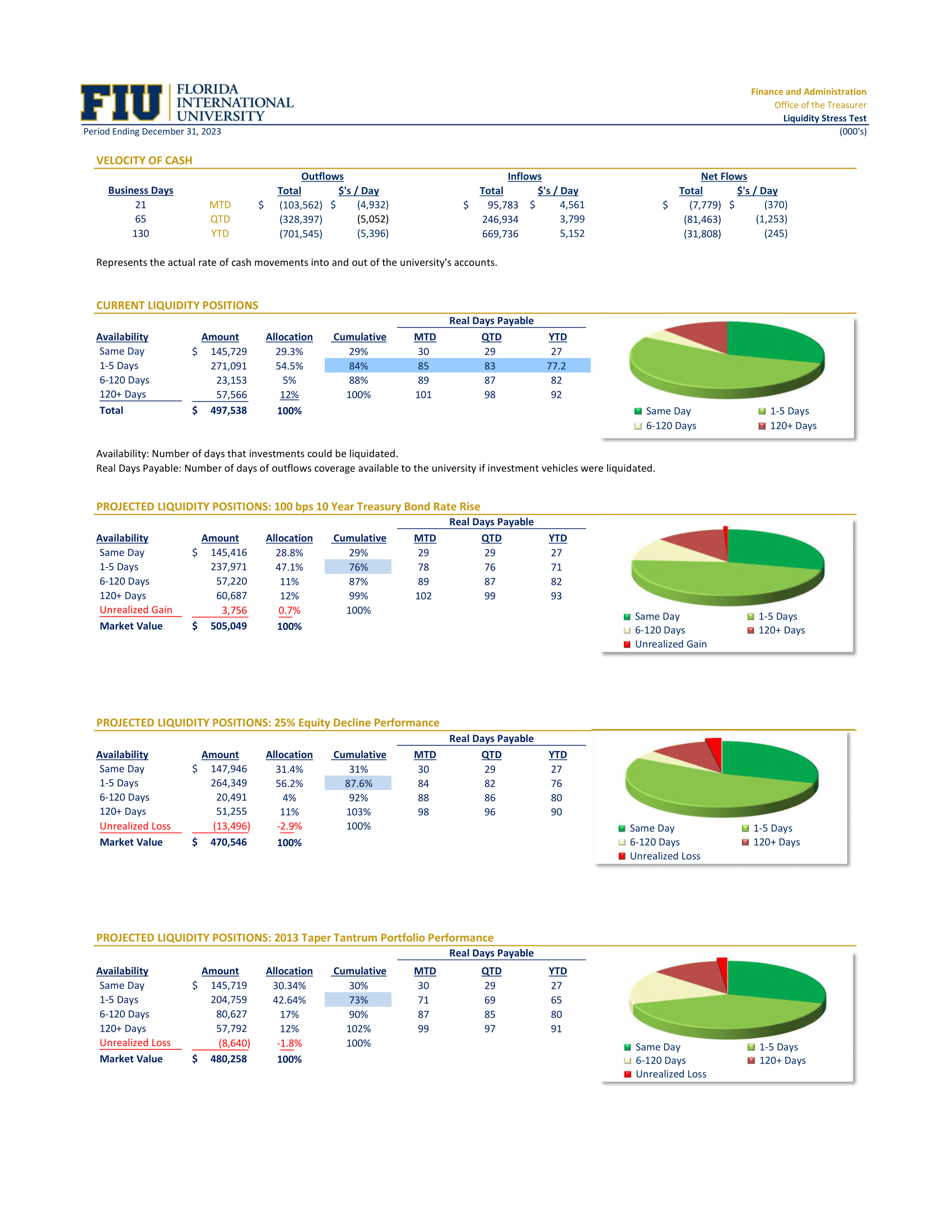

Powell Jarrell joined Florida International University in 2009, he has more than 32 years of finance, banking, and treasury experience; 16 years of corporate finance and 16 years higher education finance experience. He is responsible for the management of the university's operating fund investment portfolio, liquidity assessments, and the outstanding debt issuances.

Powell Jarrell joined Florida International University in 2009, he has more than 32 years of finance, banking, and treasury experience; 16 years of corporate finance and 16 years higher education finance experience. He is responsible for the management of the university's operating fund investment portfolio, liquidity assessments, and the outstanding debt issuances.

Gerald Grant Jr, two time "Branch Manager of the Year" for Great Western Bank, former Branch VP & Cluster Manager at Citibank, and Master of Business Administration from Florida International University, is Branch Director of Financial Planning for AXA Advisors' South Florida Branch. He also holds FINRA Series 7, 63, 65, 24, and 26 Securities Registrations and is insurance licensed. Grant now publishes financial advice through his book, 'Bold Moves to Creating Financial Wealth'. He actively participates in the South Florida community, serving on the Board of Directors for United Way of Miami-Dade. Gerald is a past-President of (NAIFA) National Association of Insurance and Financial Advisors, Miami-Dade Chapter, a past-President of the Florida International University Alumni Association, as well as a current Member of the Orange Bowl Committee, and Phi Beta Sigma Fraternity, Inc.-Theta Rho Sigma Chapter.

Gerald Grant Jr, two time "Branch Manager of the Year" for Great Western Bank, former Branch VP & Cluster Manager at Citibank, and Master of Business Administration from Florida International University, is Branch Director of Financial Planning for AXA Advisors' South Florida Branch. He also holds FINRA Series 7, 63, 65, 24, and 26 Securities Registrations and is insurance licensed. Grant now publishes financial advice through his book, 'Bold Moves to Creating Financial Wealth'. He actively participates in the South Florida community, serving on the Board of Directors for United Way of Miami-Dade. Gerald is a past-President of (NAIFA) National Association of Insurance and Financial Advisors, Miami-Dade Chapter, a past-President of the Florida International University Alumni Association, as well as a current Member of the Orange Bowl Committee, and Phi Beta Sigma Fraternity, Inc.-Theta Rho Sigma Chapter.  Dr. Barber is currently a professor for the

Dr. Barber is currently a professor for the

Ms. Martinez is the Interim Chief Financial Officer and Vice President for Finance and Administration. She is responsible for the management and administration of financial, facility, and business service operations of the University. Ms. Martinez has more than 20 years of experience in the areas of accounting, finance, real estate, investments, strategic and business planning. Prior to her appointment in this position, Ms. Martinez oversaw the alignment of divisional goals with overall FIU strategies. Ms. Martinez served as senior officer for the Finance and Administration Division and was involved in a wide variety of complex and sensitive administrative support activities. She served as the acting Vice President in the absence of the CFO and Sr. Vice President for Finance and Administration. Aime Martinez previously served as the Assistant Vice President of the FIU Foundation, Inc., and Support Organizations for five years. In this role she managed and directed the entities’ accounting, investments, budgeting, information systems, internal and external audit, and associated personnel. She also represented the Foundation and DSOs in various board, community, and business meetings. Ms. Martinez was also the Foundation’s Assistant Treasurer. Ms. Martinez has participated in various University wide committees such as the University’s Worlds Ahead Strategic Planning Committee, where she served as Chair for the Finance Committee for two plans, served on the Finance Committee of the College of Medicine Strategic Plan and is currently serving as the Chair of the Student Health Services Joint Governance Committee, Treasurer of the FIU Research Foundation and Finance Section Chief of the Emergency Operations Command Team. After several years in the private sector as an auditor and tax preparer in a public accounting firm as well as an accounting manager for an oil and gas public company, handling their financial reporting, Ms. Martinez returned to FIU in 2000. She accepted a position as Assistant Controller and worked her way to become Assistant Vice President and Associate Controller. She served in that capacity for seven years, she managed several areas in the Controllers during her tenure, including financial reporting, purchasing card program, investment and construction accounting, cash management, accounts payable, general accounting, audit, and payroll. For her outstanding service to the University Aime Martinez was awarded the FIU Presidential Excellence Award in 2006 and the FIU Presidential Service Excellence award in 2016. Ms. Martinez received a bachelor’s in accounting in 1996 with a minor in International Business and a master’s in accounting in 1999; she is also a licensed Certified Public Accountant.

Ms. Martinez is the Interim Chief Financial Officer and Vice President for Finance and Administration. She is responsible for the management and administration of financial, facility, and business service operations of the University. Ms. Martinez has more than 20 years of experience in the areas of accounting, finance, real estate, investments, strategic and business planning. Prior to her appointment in this position, Ms. Martinez oversaw the alignment of divisional goals with overall FIU strategies. Ms. Martinez served as senior officer for the Finance and Administration Division and was involved in a wide variety of complex and sensitive administrative support activities. She served as the acting Vice President in the absence of the CFO and Sr. Vice President for Finance and Administration. Aime Martinez previously served as the Assistant Vice President of the FIU Foundation, Inc., and Support Organizations for five years. In this role she managed and directed the entities’ accounting, investments, budgeting, information systems, internal and external audit, and associated personnel. She also represented the Foundation and DSOs in various board, community, and business meetings. Ms. Martinez was also the Foundation’s Assistant Treasurer. Ms. Martinez has participated in various University wide committees such as the University’s Worlds Ahead Strategic Planning Committee, where she served as Chair for the Finance Committee for two plans, served on the Finance Committee of the College of Medicine Strategic Plan and is currently serving as the Chair of the Student Health Services Joint Governance Committee, Treasurer of the FIU Research Foundation and Finance Section Chief of the Emergency Operations Command Team. After several years in the private sector as an auditor and tax preparer in a public accounting firm as well as an accounting manager for an oil and gas public company, handling their financial reporting, Ms. Martinez returned to FIU in 2000. She accepted a position as Assistant Controller and worked her way to become Assistant Vice President and Associate Controller. She served in that capacity for seven years, she managed several areas in the Controllers during her tenure, including financial reporting, purchasing card program, investment and construction accounting, cash management, accounts payable, general accounting, audit, and payroll. For her outstanding service to the University Aime Martinez was awarded the FIU Presidential Excellence Award in 2006 and the FIU Presidential Service Excellence award in 2016. Ms. Martinez received a bachelor’s in accounting in 1996 with a minor in International Business and a master’s in accounting in 1999; she is also a licensed Certified Public Accountant.

Dr Deanne Butchey is a Senior Lecturer in the Department of Finance at Florida International University (FIU) and holds a PhD in Finance. Before joining FIU, Dr. Butchey

worked as an Investment Banker and Financial Services Stock Research Analyst at Credit Suisse First Boston in their Toronto offices. Dr. Butchey has contributed significantly to FIU's initiatives to engage the community in mutually beneficial

ways. Since spring 2008, she has led a service learning project in her online Financial Markets and Institutions class where student groups teach financial literacy skills to high school students, recent immigrants and newcomers to South Florida

and other disenfranchised residents through various community centers (including the Chapman Community Partnership for Homeless), high schools, libraries and religious organizations. For this project she has been honored with the 2013 "Spirit

of Service-Learning Award" awarded by the Returned Peace Corps Volunteers of South Florida Inc. (RPCVSF), the Miami-Dade Teacher of the Year Coalition, and the Armando Alejandre Jr. Foundation. She is also a faculty advisor to ENACTUS @ FIU, a

student organization that aims to facilitate the impactful collaborations of students and community partners by creating, commercializing, and enhancing innovative social entrepreneurship projects to stimulate economic advancement.

Dr Deanne Butchey is a Senior Lecturer in the Department of Finance at Florida International University (FIU) and holds a PhD in Finance. Before joining FIU, Dr. Butchey

worked as an Investment Banker and Financial Services Stock Research Analyst at Credit Suisse First Boston in their Toronto offices. Dr. Butchey has contributed significantly to FIU's initiatives to engage the community in mutually beneficial

ways. Since spring 2008, she has led a service learning project in her online Financial Markets and Institutions class where student groups teach financial literacy skills to high school students, recent immigrants and newcomers to South Florida

and other disenfranchised residents through various community centers (including the Chapman Community Partnership for Homeless), high schools, libraries and religious organizations. For this project she has been honored with the 2013 "Spirit

of Service-Learning Award" awarded by the Returned Peace Corps Volunteers of South Florida Inc. (RPCVSF), the Miami-Dade Teacher of the Year Coalition, and the Armando Alejandre Jr. Foundation. She is also a faculty advisor to ENACTUS @ FIU, a

student organization that aims to facilitate the impactful collaborations of students and community partners by creating, commercializing, and enhancing innovative social entrepreneurship projects to stimulate economic advancement.

Powell Jarrell joined Florida International University in 2009, he has more than 32 years of finance, banking, and treasury experience; 16 years of corporate finance and 16 years higher education finance experience. He is responsible for the management of the university's operating fund investment portfolio, liquidity assessments, and the outstanding debt issuances.

Powell Jarrell joined Florida International University in 2009, he has more than 32 years of finance, banking, and treasury experience; 16 years of corporate finance and 16 years higher education finance experience. He is responsible for the management of the university's operating fund investment portfolio, liquidity assessments, and the outstanding debt issuances.